Self storage: investment opportunities in a growth industry

As the self storage industry continues to post remarkably resilient turnover figures and profits, ROC Invest is offering small investors a chance to get in on the act.

With headquarters in Canary Wharf, London, ROC Invest Ltd is an investment brokerage company that specialises in fully-managed property, including hotels, student accommodation, care homes – and self storage.

For an investment of between £3,750 and £30,000, you can buy a unit in a self storage facility ranging in size from 25 square feet to 200 square feet. This is then managed on your behalf on a six-year lease.

The idea is that you invest in the unit, and then the management company does all the business of on-site management, maintenance, cleaning etc – and letting the unit to storage clients.

High yields

The investment offered by ROC Invest offers a guaranteed net yield of 8% per annum for the first two years, and a projected 14% gross yield thereafter – not bad in today’s climate of low interest rates.

Investors actually buy a real bricks-and-mortar unit – not a proportion of the whole facility. The agreement with the facility management operates rather like an apartment placed in the hands of a letting agency: full management fees are payable only when the unit is occupied and yielding a rental income, and not when it is empty.

Some self storage facilities in the UK are known to operate on a 60% occupancy rate, so investors need to be sure that their unit is being used as fully as can be expected, and in proportion to the occupancy rate of the facility as a whole. According to ROC Invest, this is achieved by working on a rotational basis – but investors might like to find out quite how that works in practice. All units, after all, are not equal.

For investors who wish to sell up early, there is a “defined exit strategy”, offering a variety of opt-out possibilities, including guaranteed buyback, and selling on the unit (and outstanding management contract) to other parties.

Self storage in your pension plan

Because storage units are classified as commercial assets, they fall under the investments that can be brought into a SIPP (Self Invested Personal Pension).

As ROC Invest puts it, self storage is one of their “fully managed products that typically outperforms the standard UK ‘buy to let’ sector”.

Focus on the North West

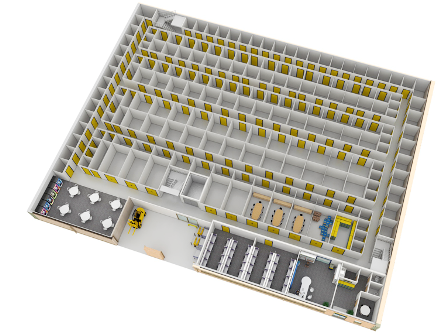

ROC Invest is currently offering units at a self storage facility in the Centurion Business Park in Blackburn – a modern, purpose-built and fully secure self storage facility, managed by a national company.

They have further sites on offer, or pending, totalling 12 in all, many of which are operated by Storefirst, and in the North West.

One Response to “Self storage: investment opportunities in a growth industry”

Leave a Reply

Subscribe to This Blog

Get new blog posts sent to you by subscribing to RSS updates or to email updates.

ARE INVESTMENT/PRICES TENURE/ DETAILS AVAILABLE PLEASE?